Debt is the slavery of the free.

- Publilius Syrus

Here you are at the home stretch. It’s time to dig deep and use your momentum to get yourself across the finish line. This last step is what will separate the good from the great.

The enemy of great is good enough.

It’s easy to take your foot off the gas when things start to get a little more comfortable.

Before we dive in, let’s take a quick look at where you are:

- You know your income and living costs

- You’re tracking your income and expenses with a budget

- Your high-interest debts have been consolidated to lower-interest rates with targeted payoff dates

- You have a $5,000 emergency fund

- You are automatically saving for retirement (and possibly college)

Now it’s time to beef up your savings, and kick the debt to the curb for good.

Table of Contents

The Strongest Tool in Your Belt

“Your home is your greatest wealth building tool.”

It’s a common adage, and it’s wrong. For most American homeowners, their home does end up being their largest asset. That isn’t usually by choice, it’s because they didn’t properly save and invest throughout their working life. They made their mortgage payments for decades, spent what they had left, and their home may have gone up in value at the same time.

If they are lucky enough to retire, they end up with most of their net worth tied up in an asset that they can’t use to buy groceries or pay taxes. In order to tap that money, they have to sell it or take out more debt against it.

The greatest wealth building tool most people will ever have is their income.

That constant stream of money that comes in the door. The problem is so many people spend everything they make and basically cap off of the largest access to money they will ever have.

Instead of using their income as a tool to make their financial future brighter, they use it as the guide for how much money they can spend and what quality of life they can live in the given moment.

Income goes up? Time to get a nicer car.

End of the year bonus? Let’s take that trip we “deserve.”

Use Your Income as a Tool

Combined with a budget, your income becomes a very potent tool to build wealth. The more of it you can free up on a monthly basis, the more you can pay down outstanding debts and build your savings. As the debt goes away more of your income is freed up, making the process even faster. It’s like a snowball rolling down a hill, getting larger and larger.

Take a look at your budget and calculate how much money you pay in debt payments on a monthly basis. If you have a few cars and a couple loans it could easily be $1,000 or more. Imagine if all that money was yours each month and not owed to someone else. Cash for you to save and invest.

Get the (Snow)Ball Rolling

The hardest part about making snowmen body parts is the first few rolls through the snow. The ball is tiny, and it takes a while to start building up. The same goes for freeing up cash to pay off your debt and save.

If you take a look at your budget and see there isn’t much extra after all the necessities, bills and debt payments, it’s time to make some choices. Going through your budget line-by-line, you should find areas that you can cut back on (at least temporarily). The goal at this step is to pay off debt and build a sizable emergency fund as quickly as possible.

Wants vs. Needs

As you revisit your budget, it’s important to look at each category through the wants vs. needs prism and remember that this is temporary. I’m sure there is great content on Netflix, Hulu, HBO Go, Apple TV, and Crackle, but do you need to subscribe to all of them right now? The more you can cut back on in the short term, the better you will be in the long term.

Here’s a list of ideas where you could temporarily cut back to help your monthly cash flow:

- Groceries - Make a weekly meal plan to cut down on wasted food.

- Clothing - Reduce the amount of new clothes, and/or shop at cheaper stores.

- Dining Out - Cook at home as much as possible, and/or switch to fast-casual dining for a while.

- Vacation - Hold off while trying to save money, or try a staycation.

- Christmas - Set a reasonable gift budget and stick with it.

- Household - Suspend home good purchases unless absolutely necessary (new picture frames are rarely a necessity).

- Technology - Skip an upgrade cycle or two. Your phone will still open Instagram.

- TV / Internet - Check your plans and see if there are cheaper options.

Cutting back on things you’ve grown accustomed to can be daunting. Keep in mind these are temporary measures to put you in a much better place. You may be surprised how few of them you actually add back when you can.

The pendulum can also swing too far if you’re not careful. There is a freeing feeling that often comes with reducing your expenses, and it can lead to cutting too much in the wrong areas. For example:

- Insurance - Do not lower your coverage to save a few bucks on premiums. A few dollars saved could spell disaster later.

- Home Maintenance - Pushing off needed maintenance could exacerbate issues down the line. Keep your home in working order. (A new gazebo is not home maintenance.)

- Car Maintenance - Same as your home, keep your car in working order and get it regularly serviced. It’s cheaper to keep it maintained than fix it when broken.

Retirement and College Savings

You may be thinking about all the money you automated in Step 5 towards retirement and college savings. It’s likely to be a big chunk of cash being tied up each month, and you’re wondering if suspending those savings goals is a good idea.

The answer is, “it depends.”

In Step 3 we talked about the pitfalls of consolidating credit card debt if you have a spending problem. The consolidation would effectively free up your credit cards, putting you in a worse position if you continued to spend beyond your means.

The same principle applies here.

By turning off retirement and college savings, your monthly income available to spend will rise. This can greatly increase the speed in which you pay off your debts and save cash, or it can continue to inflate your lifestyle until there is no money left over for those important savings goals.

If you think there is a chance you could end up spending it, don’t suspend those monthly savings. It’s better to get across the finish line a little slower, than never getting there at all.

If you have bought 100% into getting out of debt and bulking up your savings, consider waiting a few months to lower your contributions. Make sure your motivation isn't fleeting, and you are sticking to the plan. Once you are done with Step 6, you can supercharge your retirement and college savings with your freed up cash and make up the time you lost.

Do not lower your 401k contribution below your employer’s match (if they have one). It’s free money. Don’t leave it on the table.

Emergency Fund or Debt First?

There are different opinions about the order in which you should accomplish this. Some argue it doesn’t make sense to earn less than 1% on your savings while paying potentially 10% in interest, so they would advocate for paying debt off first. Others claim having a cash cushion to soften unexpected financial blows will prevent you from going further into debt, and potentially losing the emotional drive to continue with your plan. They would advocate for building the emergency fund first.

The choice is up to you.

If the debt is causing anxiety, go all in on that first. If having extra cash in the bank will help you sleep at night, build up your emergency fund. If you really can’t decide, you can do both at the same time. Pick a percentage of your available monthly snowball and put some aside while you use the rest to pay off your debt.

Folks often get lost in the math while forgetting a large part of personal finance is behavioral. Squeaking out an extra percentage point or two won’t do you any good if you can’t stick with the overall plan.

Fully-Fund Your Emergency Fund

In Step 3 you focused on saving $5,000 as a starter emergency fund to cover any unexpected emergencies while you worked through the steps. While that is a good start, $5,000 can go incredibly quickly if something like a job loss or medical issue comes up.

The definition of a fully-funded emergency fund can vary depending on your financial situation, but for this step we will assume you do not have a healthy taxable brokerage account or other assets that you can rely on.

3-6 Months of Expenses

The generally accepted amount for a personal emergency fund is three to six months worth of your household expenses. It’s important to note the last word, expenses. That means what it takes to keep operating your household on a monthly basis, not the income earned.

In the event of something major like a sudden job loss, the first order of business should be to discontinue all discretionary savings goals and increased debt payments, shut down unnecessary expenses (like Spotify), etc. to limit the amount of money leaving the household. The remaining total is what you use to calculate your monthly spend in an emergency.

How Many Months Do You Need?

Whether you settle on three months, six months or somewhere in between will be up to you and your personal situation.

If you have a very steady job, have dual incomes or live pretty well below your means, you may be comfortable on the lower end of the scale. If your job isn’t very secure, or it would take a long time to replace your current income, you may lean toward the higher side.

There is no hard and fast rule here, but you should shoot for a minimum of three months. Once you are debt free, you can add to it pretty quickly.

Time to Retire the Debt

Remember when you were a kid and if you wanted to buy something you had to have the money to pay for it? You spent, you consumed, then you went along with your day. It’s a stark contrast from adulthood, where a single impulse can follow you around for months or years.

If you’re like most Americans, you have been in debt for the majority of your adult life. It usually starts off small, perhaps a secured credit card or a department store charge card, and seems to keep growing. Before you know it, you have car payments, student loans, credit card bills, and payments to a furniture store.

Many people assume debt is a part of life. While it is for most, it certainly doesn’t have to be. There is a way out, and here it is. It won’t be easy, but it’s worth it.

Payoff Strategies

There are a number of strategies people use to pay off their debt, but there are two that stand the test of time. If you don’t have valuable assets to sell or a wealthy benefactor to help you out, either one of these will get the job done.

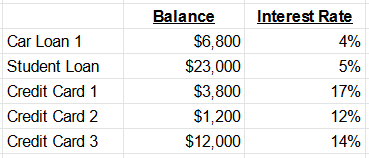

The first thing you need to do is compile a list of all your current debts along with their current balances and interest rates. If you consolidated them on Step 3, hopefully the list is pretty short. Even if you didn’t, the same process will be applied.

Here is an example:

With both of the strategies outlined below, you make the minimum payment on all your debts, and throw every extra dollar you can get out of your budget at a single one. The purpose is to start closing debts out as quickly as possible, not slowly paying them all off at the same time.

The only difference between the two approaches is the order in which you pay them off.

Debt Avalanche

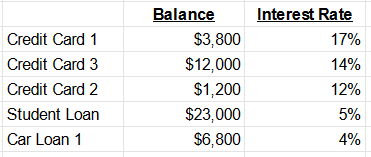

The debt avalanche method orders the debts from highest interest rate to lowest, then attacks the one at the top of the list. When that one is paid off, you move on to the next one. Here is that same list of debts ordered for a debt avalanche:

The benefit to the debt avalanche is you reduce your highest interest rates first, so you end up paying less interest and theoretically get out of debt a few months sooner. This approach is good for people that can stay motivated for months (or years) at a time.

The major drawback to this approach is many people quit because they don’t feel like they are making enough progress. In the example above, an individual paying $1,000 extra a month could get discouraged when they are still on Credit Card 3 after a year.

Debt Snowball

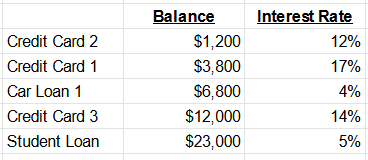

The debt snowball method orders the debt from smallest to largest, and also starts paying off the top of the list first. When one debt is completely paid, the snowball then moves on to the next. Here’s how the example would look:

The advantage of this method is you start by getting quick wins, and your total number of monthly payments starts to go down faster. The same individual mentioned above would have paid off two credit cards and their car loan in the first 12 months. This can create a psychological boost that prepares them for the larger balances coming up.

The disadvantage to this approach is mathematically it can take a little longer, and might cost a bit more in interest charges.

Which Strategy is Better?

Our recommendation for most people is the Debt Snowball.

On paper, the Debt Avalanche is mathematically superior, but if math was the driving factor for how everyone made their financial decisions no one would be in this mess.

The reality is people are driven by emotion, and paying off an entire balance is incredibly motivating. It can often take years to fully pay off everything, and running up against a multi-year debt mountain early can cause people to throw in the towel. By crossing the smaller debts off first, you build momentum to help the steep climb in the end.

However, when you organize your debt list, don’t be afraid to move things around a bit if it makes sense for your situation. For example, if you have two debts that are close in size, but the larger one has a much higher interest rate, it’s fine to switch the order.

Additionally, you may want to start using the Debt Snowball to knock out some of your smaller balances, and then change to the Debt Avalanche once you really have the ball rolling.

Tapping the Emergency Fund

This final step will most certainly be the longest. Things may pop up, so it’s important to roll with the punches. Since you could be on the debt payoff part for months or years, it’s possible that you will need to tap your emergency fund a few times during the process.

The good news is, that’s what it’s for!

The emergency fund is especially important at this stage because it can help prevent you from adding to your debt while you are trying to pay it off.

If you do have to tap into it, simply halt the extra debt payment and redirect it to savings. Once you get your emergency fund back to where it’s supposed to be, restart the debt payoff.

Final Thoughts

People overestimate what they can do in a year, and underestimate what they can do in ten.

We live in a society where instant gratification and immediate results have become the norm. Success in personal finance is a lifelong journey, and putting the pieces in the right places will get you there.

You didn’t get yourself into this mess overnight, and you won’t get out of it overnight either. Don’t worry about not starting this five years ago, but think about where you will be five years from now. That time will come regardless of what you choose, but where you will be is completely up to you.