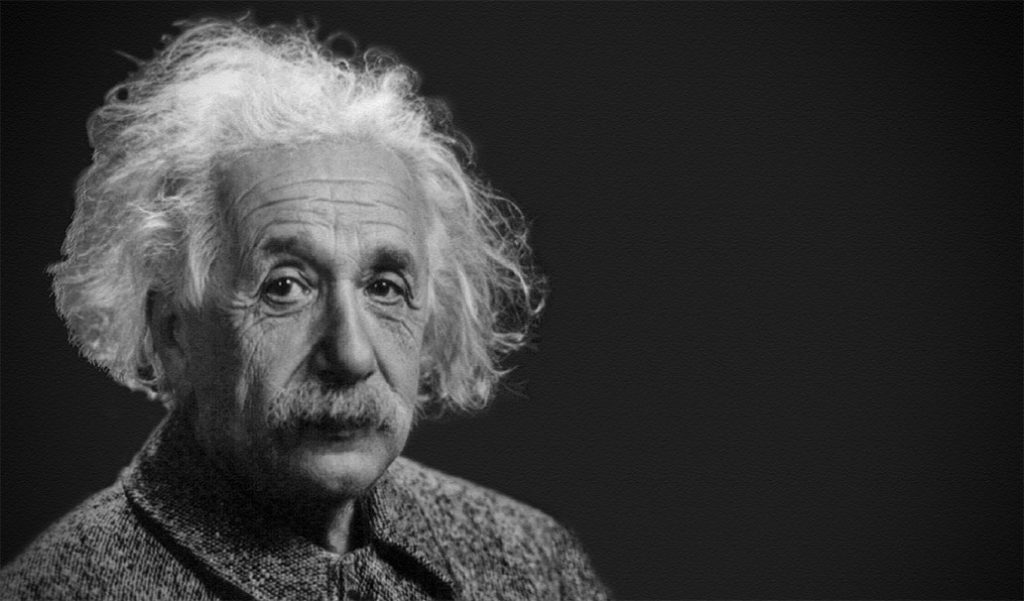

Compound interest is the eight wonder of the world. He who understands it, earns it; he who doesn't, pays for it.

- Albert Einstein

You have probably heard the term before, but may be a little hazy on the details. In a nutshell, compound interest is when the interest you earn also earns interest. Over long periods of time, this earned interest can become the lion’s share of an entire investment. It’s the driving principle behind the success of people like Warren Buffett.

For a robust explanation of how this works, visit our post titled, The Power of Compound Interest.

Table of Contents

Compound Interest Works Both Ways

If this page is about consolidating debt, why are we talking about compound interest?

For many households, debt has been a part of life since late teenage years when credit cards became accessible. To make matters worse, over half of Americans do not pay off their credit cards each month.

Carrying credit card balances is akin to paying compound interest, rather than earning it. Each month that you carry a balance, the bank will add an interest charge to your balance. The next month that interest charge will also be charged interest, on top of your remaining principal balance.

If earning compound interest is the path to wealth, paying compound interest can be a huge driver in the opposite direction.

Interest Rates are Incredibly Important

When borrowing money, one of the most important factors is the interest rate associated with the debt. The interest rate is the “fee” being charged by the bank (or other entity) for the privilege of using their money.

Interest rates are almost always calculated using an annual basis. Here is a simple example:

10% interest on a $5,000 loan would be $500 a year (assuming no payments were made).

This simplified example doesn’t account for things like payments or compound intervals, but shows the basics of how it works.

The average credit card interest rate in the United States sits around 16%. That means that, on average, Americans pay around $1,600 in interest charges per $10,000 worth of credit card debt they carry for a year.

According to Lending Tree, Americans have just over $800 billion in credit card debt. That means we pay as a country about $128 billion in interest payments per year.

That is not helping anyone build wealth.

How Debt Consolidation Works

The term “debt consolidation” is pretty self explanatory: It’s taking multiple debts and combining them into one (or a few) loans.

Let’s assume Susan has three credit cards with balances that she maintains from month-to-month. Here are the details:

- Credit Card 1 - $5,500 balance at 19% interest

- Credit Card 2 - $2,500 balance at 15% interest

- Credit Card 3 - $1,000 balance at 22% interest

This example is likely familiar for a lot of people. Anyone who has carried multiple credit card balances at one time understands how stressful it can be. You seem to have a new payment nearly every week, and it often doesn’t feel like you are getting anywhere since the interest keeps piling up.

Susan currently has $9,000 in credit card debt, and is responsible for three separate payments each month. Any missed or late payments will not only add fees to her balance, but will also have a negative impact on her credit score. Since credit cards are revolving accounts, it can be difficult for her to determine when a card would be fully paid off without doing some non-trivial math calculations.

This could be a perfect situation for Susan to consolidate her debt with a personal loan.

Assuming Susan has decent credit and a steady job, she may be eligible to take out a personal loan for $9,000 and pay off her credit cards. Personal loans generally come with lower interest rates than credit cards, which would save her quite a bit of money over the current setup.

Besides the lower interest rate Susan will pay, another benefit to this type of debt consolidation is she could get onto a structured payment plan with a defined end date. By moving the debt from a credit card to a personal loan, Susan will have a set payment each month and a predetermined payment plan from start to finish.

When Does Debt Consolidation Make Sense?

Debt consolidation is not a silver bullet that will solve all your debt issues. The primary drivers of consolidating your debt should be 1) to lower the interest you need to pay, and 2) structure a payment plan that gets rid of the debt with a predefined timeline.

The perfect candidates for debt consolidation are credit cards. They almost always carry very high interest rates compared to other products on the market.

While credit cards are the most obvious, really any debt that carries a higher interest rate than you could feasibly get could be a candidate for consolidation. For example, if you took out a car loan years ago when you had bad credit, it might make sense to lump your remaining balance into your consolidation.

Tools to Consolidate Debt

Debt consolidation isn’t a banking product itself, but rather a concept of pooling multiple higher-interest rate debts into a lower-cost, single payment. This can be accomplished with a number of different tools.

Personal Loan

Personal loans are a good solution for consolidating high-interest debt when the borrower has steady income and good credit.

A personal loan is not backed by a specific asset (like a mortgage or auto loan) so the credit-worthiness of the borrower is very important. Borrowers with less-than-ideal income and credit history may find it difficult to get approved for a low-interest personal loan.

Those with heavy credit card debt loads may also find it difficult to, 1) get approved in general, or 2) get approved for enough credit to cover their other debts.

Cash-out Mortgage Refinance

With mortgage interest rates at historic lows, many people have turned to refinancing their mortgage with a cash-out option to consolidate their debts.

Cash-out refi’s (as they are called) are when the owner of a home takes out a larger mortgage than what they currently owe, pays off the old mortgage, and keeps the difference. This is common when people want to consolidate other debts, and/or make additions and upgrades to their home.

Mortgages generally carry lower interest rates and longer terms than just about any other type of debt. However, the process is much more cumbersome, and the costs of refinancing are often many thousands of dollars.

Home Equity Line of Credit (HELOC)

If you own a home and have a reasonable amount of equity (Home Value - Amt Owed) built up, you can establish a home equity line of credit, or HELOC.

A HELOC is similar to a credit card, but has your house as collateral. Since the line of credit is backed by your home, the interest rate will generally be quite a bit lower than a credit card.

Credit Card Balance Transfer

If you've had credit cards for any amount of time, you have probably received offers for a credit card balance transfer.

For the uninitiated, many credit cards offer the ability to transfer some or all of another credit card’s balance onto their card, while giving you some time period with reduced or zero percent interest. It’s common to see offers for 15 months with no interest on balance transfers.

If you have a credit card (or apply for a new one) that has a sizable limit and can accommodate the other balances, a credit card balance transfer could be a decent option. The longer they offer a reduced (or zero) interest rate, the better.

If these offers are available, this route is usually the easiest and quickest. It doesn’t require a credit check, and the balances can often be transferred in as little as a week.

The downside to this strategy is you have no predefined payment plan. That means if you don’t pay off the entire balance by the end of the promotion period, you will start paying interest again at whatever the current credit card rate is.

The Major Drawback

Consolidating your debts into one payment at a lower interest rate sounds like a no-brainer. However, there is a MAJOR DRAWBACK for some people.

Unfortunately, the only thing that prevents some folks from racking up more debt on their credit cards is their cards being maxed out. While this is stressful for anyone, it can be a silver lining for people with severe spending problems.

IF YOU DON’T CHANGE YOUR SPENDING HABITS, YOU WILL FIND YOURSELF IN A WORSE POSITION DOWN THE ROAD.

If you are someone that tends to rack up credit card balances and not pay them off, wiping your cards clean could be a recipe for disaster. You didn’t actually get rid of your debt by consolidating, you just transferred it somewhere else.

Debt consolidation is a powerful tool, but only when used correctly and part of an overall strategy to better your financial position. If used improperly, it can lead to more financial headaches if the debt returns over time to the credit cards.

When Should You Consolidate?

Our general recommendation is if your high-interest rate debt (like credit cards) is larger than 10% of your annual gross income, you should consider consolidating your debt and developing a payment plan to get it knocked out in no more than three years.

If this part of your debt is below 10% of your income, you need to do a little research to figure out if consolidating is worth the effort and cost. You wouldn’t want to pay $5,000 in closing costs on a cash-out refi, in order to save $1,000 in interest.

We will tackle the strategy for paying all your debt off in Step 6.

Summary

With us so far? If so, you should:

- Know your income and living costs.

- Have a budget and tracking expenses.

- Have consolidated your high-interest debt into lower-cost loans.

Up next you are going to save a small emergency fund to put some distance between you and life's little mishaps.